Causal: The Modern Approach to Business Planning

Product Information

Causal: Rethinking Financial Modeling and Business Planning

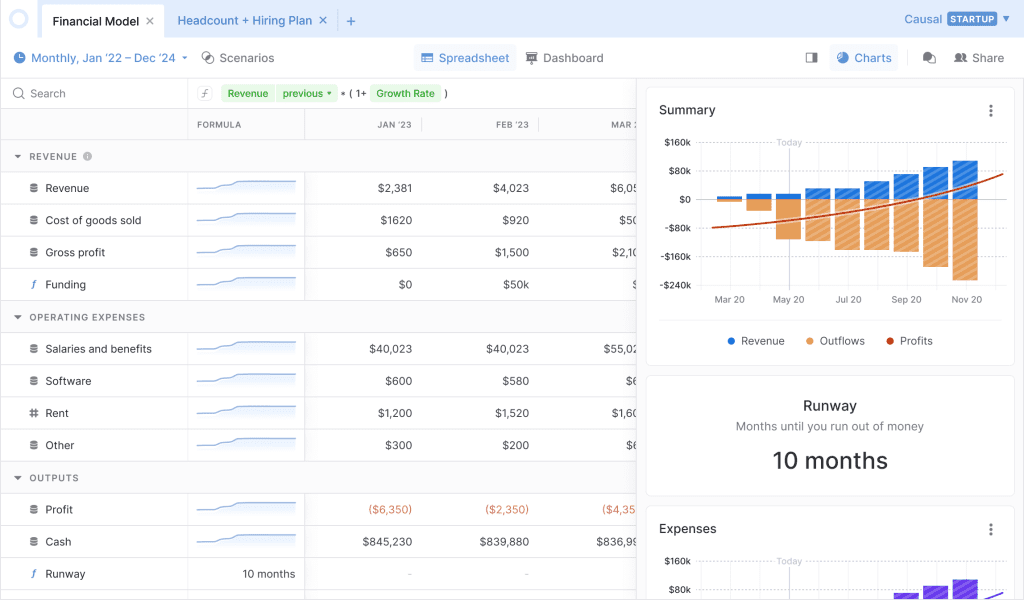

Causal is designed to be the modern solution for those looking to build and automate their financial models, business plans, board reports, and forecasts. It addresses the common challenges faced by professionals who grapple with cumbersome spreadsheets, CSV wrangling, and outdated files. Instead, Causal offers a platform where users can share live reports that drive better decisions, all within a matter of minutes.

A Unified Platform for All Stakeholders

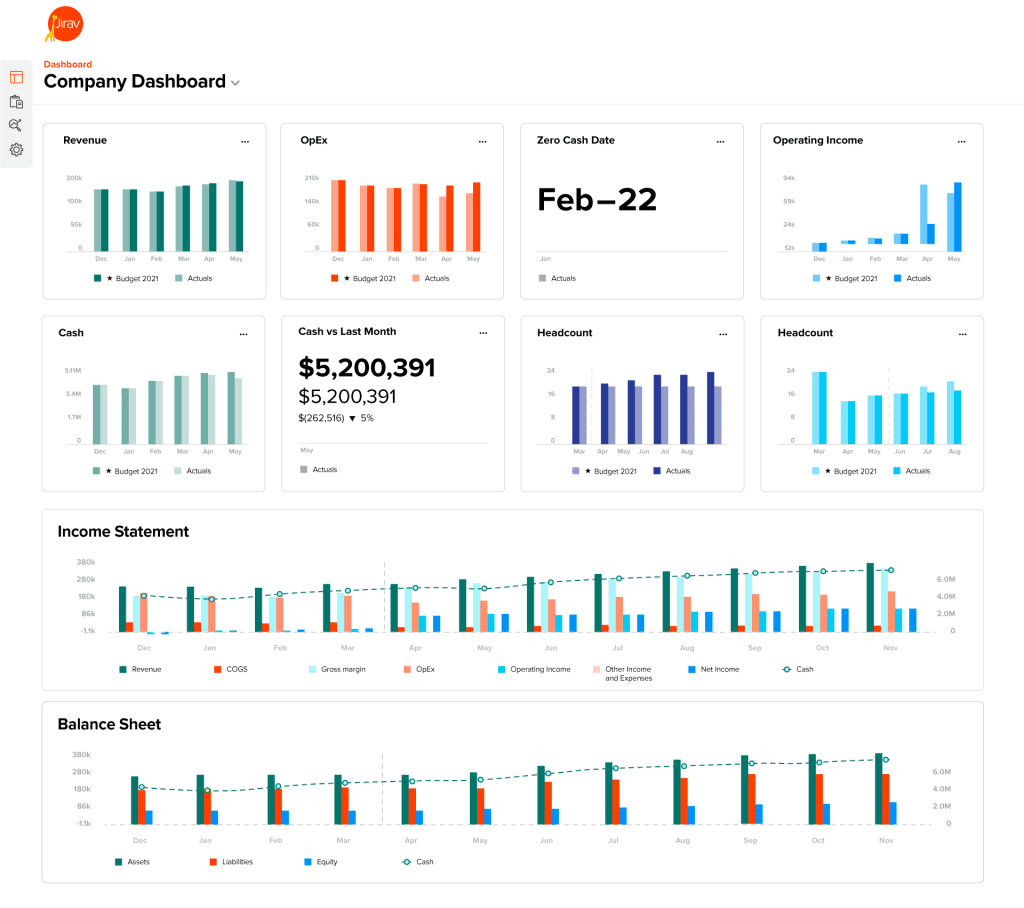

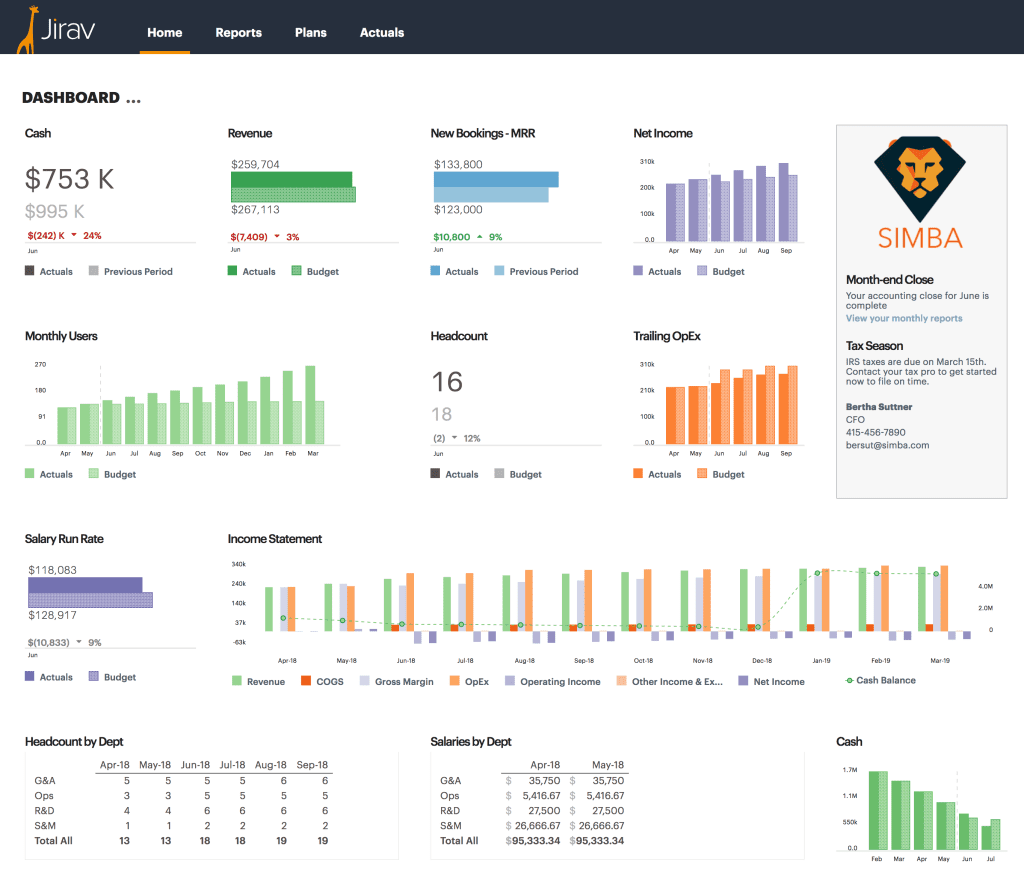

Causal serves as a single platform catering to a diverse range of users, from financial modelers and business teams to CEOs and executives. Whether you’re in finance, a startup, revenue & operations, or HR, Causal has tailored solutions to meet your specific needs.

Features

All Your Planning, Unified

Causal offers a comprehensive suite of features designed to streamline and enhance the planning process:

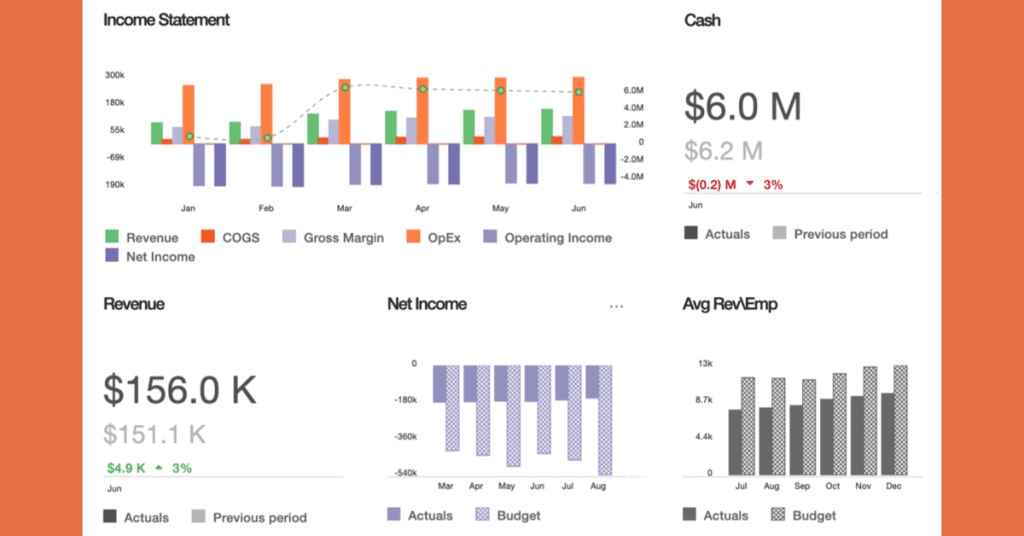

- Automated Reporting: Shift from manual processes to automated reporting, ensuring timely and accurate insights.

- Multi-dimensional Modeling & Scenario Planning: Dive deep into your data, explore various scenarios, and make informed decisions.

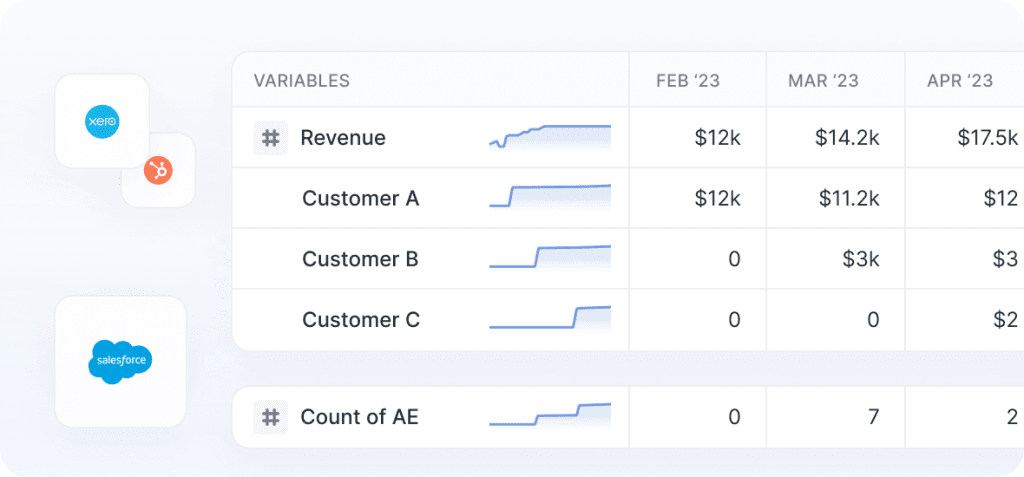

- Live Integrations: Seamlessly integrate with ERPs, CRMs, data warehouses, and more, ensuring that your data is always up-to-date and accurate.

- Templates: Get started quickly with out-of-the-box templates built on best practices. Whether you’re looking at headcount, profit & loss, or B2B SaaS revenue, there’s a template to jumpstart your planning.

- Customization: Tailor your models to your needs. Adjust assumptions, tweak formulas, and create custom what-if scenarios to explore various possibilities.

- Real-time Collaboration: Share dashboards with your team and collaborate in real-time. With live editing and commenting, ensure that everyone is on the same page.

Why Choose Causal?

Causal is not just another planning tool; it’s a platform designed to elevate your planning process:

- Increase Productivity:

- Automate data collection

- Create a single source of truth

- Analyze granular data with interactive dashboards

- Flexibility & Scalability:

- Build models that adapt to your needs

- Run scenarios with a single click

- Track your progress over time

- Collaboration:

- Cut out the need for endless email threads and Slack messages

- Collaborate in real-time within Causal

- Share insights

- Embed live tables and charts in tools like Notion and Google Slides

Integrations

Causal boasts a range of integrations with popular platforms:

- Accounting/ERP: Integrate with platforms like QuickBooks, Xero, NetSuite, and more.

- HRIS: Seamlessly pull data from HR platforms like Workday.

- CRM: Ensure your sales data is always updated with integrations like Salesforce.

- Data Warehouses: Connect with data warehouses like Snowflake to ensure a holistic view of your data.

Pricing and Plans

As with many business software solutions, the price varies depending on the organization’s unique needs and size. For a detailed breakdown of pricing and available plans, please contact Causal directly or sign up on their website for more information.

However, Causal is trusted and used by a wide range of users, from startups to established companies. The testimonials on the website highlight the platform’s effectiveness and user-friendliness, with many users praising its capabilities over traditional spreadsheet tools.

In conclusion, Causal offers a fresh and modern approach to business planning, financial modeling, and reporting. By combining the familiarity of spreadsheets with advanced features and integrations, Causal ensures that businesses have the tools they need to make informed decisions, collaborate effectively, and drive growth. Whether you’re a financial modeler, a startup founder, or a CEO, Causal provides a unified platform to meet all your planning needs.