Anaplan – Revolutionizing Financial Performance Management

Product Information

Anaplan: The Cornerstone of Connected Planning

Anaplan emerges as a transformative solution in the realm of financial performance management. With its Connected Planning Platform, Anaplan empowers businesses to see clearly, plan effectively, and lead with unparalleled confidence. Recognizing the multifaceted challenges that modern businesses face, Anaplan offers a platform that seamlessly integrates various departments, from finance to sales to HR, ensuring holistic planning and decision-making.

The platform is not just about financial tools; it’s a comprehensive solution designed to bridge the gap between data and actionable insights. Whether it’s budgeting, forecasting, or reporting, Anaplan ensures that businesses have the tools they need to drive growth, adapt to changing market dynamics, and achieve their financial objectives.

—

Features

Anaplan: A Comprehensive Suite for Financial Performance Management

Anaplan boasts a plethora of features tailored to enhance the financial planning and analysis process:

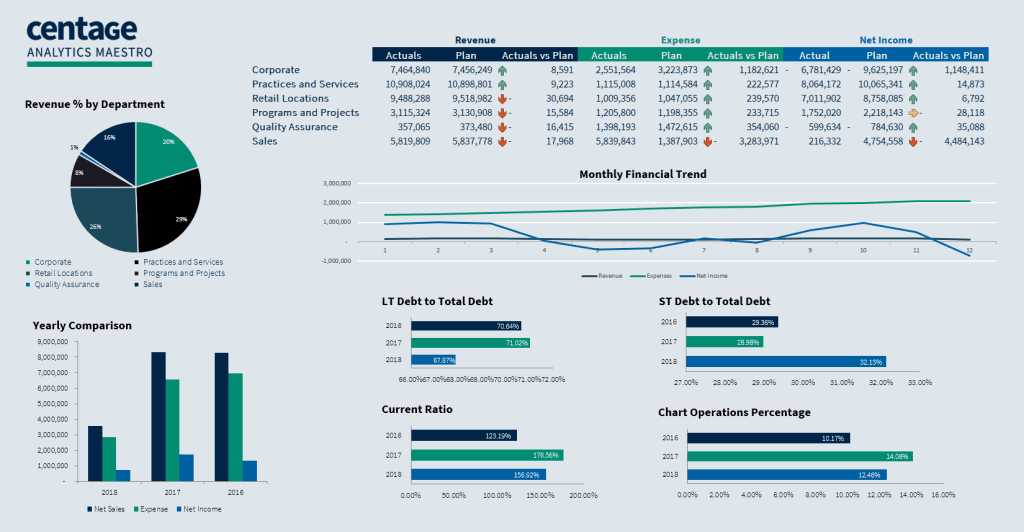

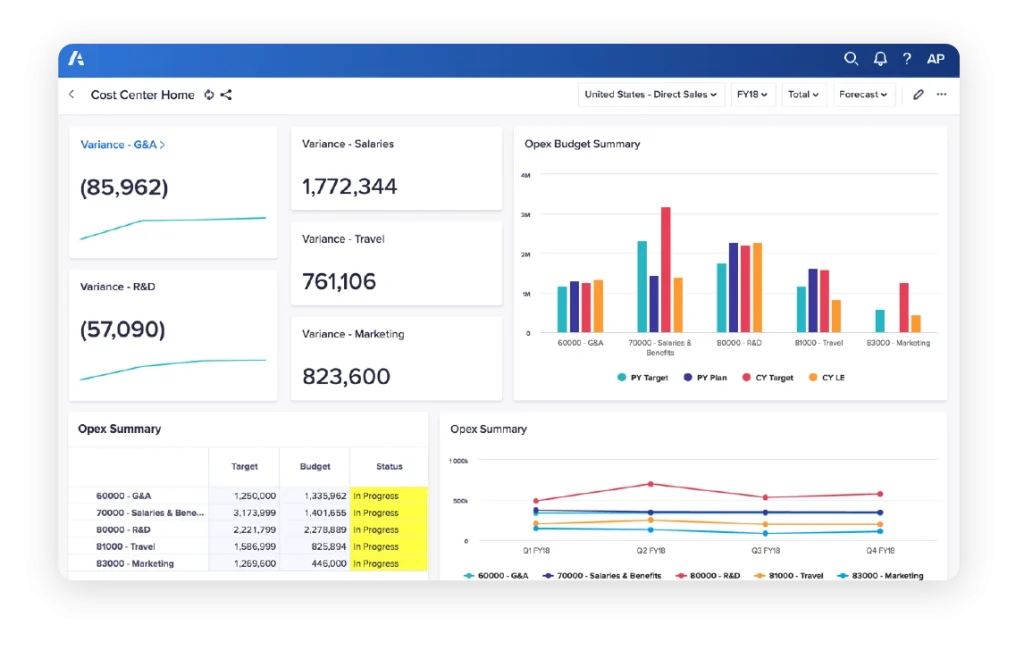

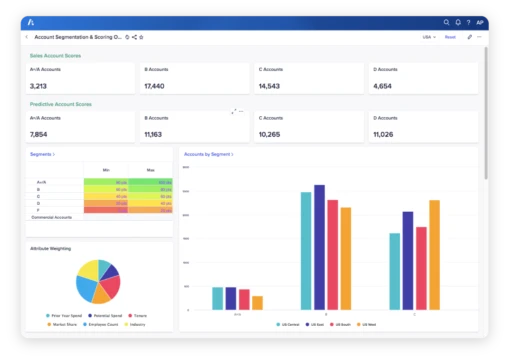

– Real-time Analytics: With Anaplan, businesses can transition swiftly from data collection to decision-making, ensuring timely insights that drive strategic actions.

– Collaborative Planning: Foster a culture of collaboration with tools that allow various departments, from finance to marketing to operations, to align their objectives and strategies.

– Effortless Analysis: Drive performance with user-friendly dashboards, data visualizations, and automated insights that provide a clear picture of the financial landscape.

– Agile Planning: Adapt to changing business conditions with Anaplan’s flexible financial planning tools, ensuring accuracy, collaboration, and foresight.

– Integrations: Anaplan offers seamless integrations that unlock the value trapped within existing systems, ensuring comprehensive data connectivity and a holistic view of financial performance.

– Real-time Reporting: Share insights with stakeholders in real-time, ensuring transparency, alignment, and informed decision-making.

– Strategic Integration Partners: Anaplan’s strategic integration partners ensure that the platform can be seamlessly integrated with other business tools, enhancing its utility and ensuring a unified approach to financial management.

– Customer Testimonials: Numerous testimonials from satisfied customers underscore the platform’s versatility, ease of use, and the transformative value it brings to financial planning and analysis.

—

Pricing and Plans

The specific details regarding Anaplan’s pricing and plans were not explicitly mentioned on the provided page. As is common with enterprise-level solutions, pricing often varies based on the unique needs and scale of the organization. For those interested in understanding the cost structure, Anaplan offers the option to experience the platform firsthand, which can be accessed via their website.

Anaplan’s platform is trusted by a myriad of businesses, emphasizing its effectiveness in catering to various financial planning needs. The platform’s emphasis on real-time collaboration, combined with its robust feature set, makes it a preferred choice for businesses looking to elevate their financial planning and analysis processes.

—

In conclusion, Anaplan offers a comprehensive solution for businesses aiming to streamline their financial planning, forecasting, and reporting processes. With its range of features, from real-time analytics to collaborative planning, and its emphasis on integration and transparency, Anaplan ensures that businesses are equipped with the tools and insights they need to navigate the complexities of financial planning in today’s fast-paced business environment.