Centage – Elevating Financial Planning and Analysis

—

Product Information

Centage: Simplifying FP&A for Modern Businesses

Centage stands as a beacon in the realm of financial planning, budgeting, and analysis. With its cloud-based solutions, it aims to make these processes not only accessible but also straightforward for businesses of all sizes. Recognizing the challenges that finance teams face, from data consolidation to forecasting accuracy, Centage offers a platform that addresses these pain points head-on.

The core of Centage’s offering is the “Planning Maestro®,” a comprehensive solution that encompasses a range of FP&A capabilities. From consolidation and budgeting to scenario planning and reporting, Planning Maestro® ensures that finance teams have all the tools they need at their fingertips.

Centage’s commitment to simplifying FP&A is evident in its approach. By offering a single source of truth across the business, it improves visibility and ensures that all stakeholders are aligned. The platform also emphasizes agility, promoting continuous budgeting and planning, which is crucial in today’s dynamic business environment.

—

Features

Planning Maestro®: A Symphony of FP&A Features

Centage’s Planning Maestro® is designed to be the one-stop solution for all FP&A needs:

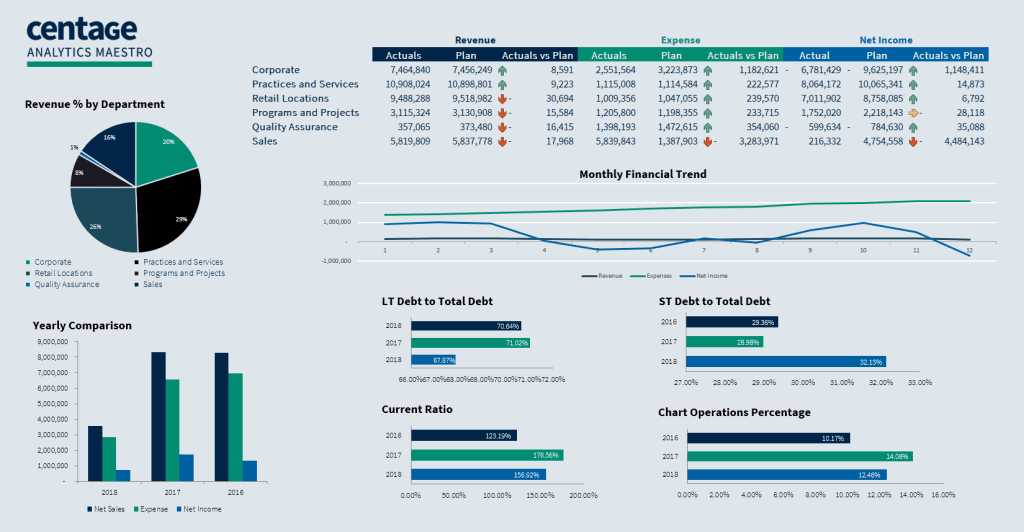

– Consolidation: Bring together data from various sources, ensuring a holistic view of your financial landscape.

– Budgeting: Streamline the budgeting process, ensuring accuracy and timeliness.

– Forecasting: Predict future financial trends with confidence, leveraging Centage’s advanced algorithms.

– Scenario Planning: Evaluate different financial scenarios, ensuring that your business is prepared for any eventuality.

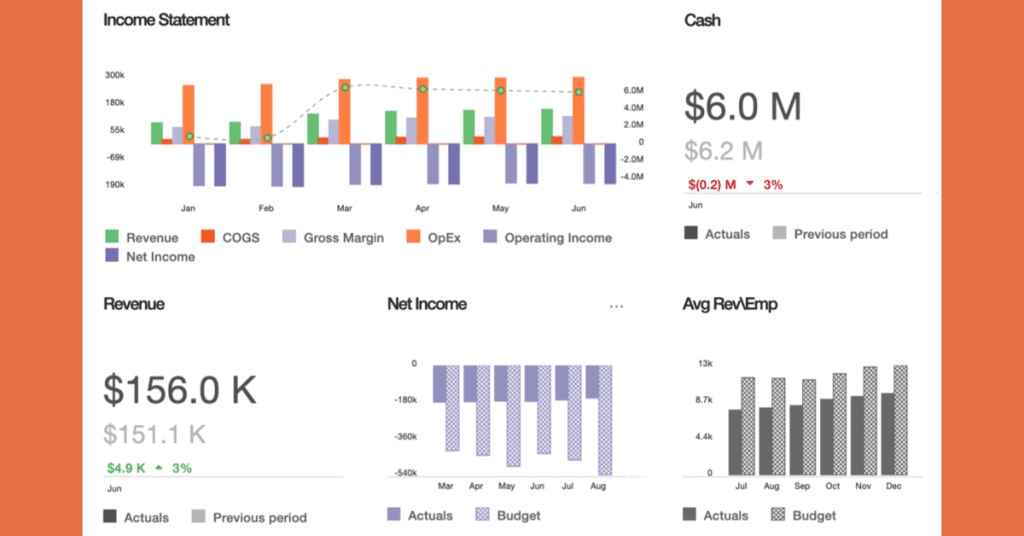

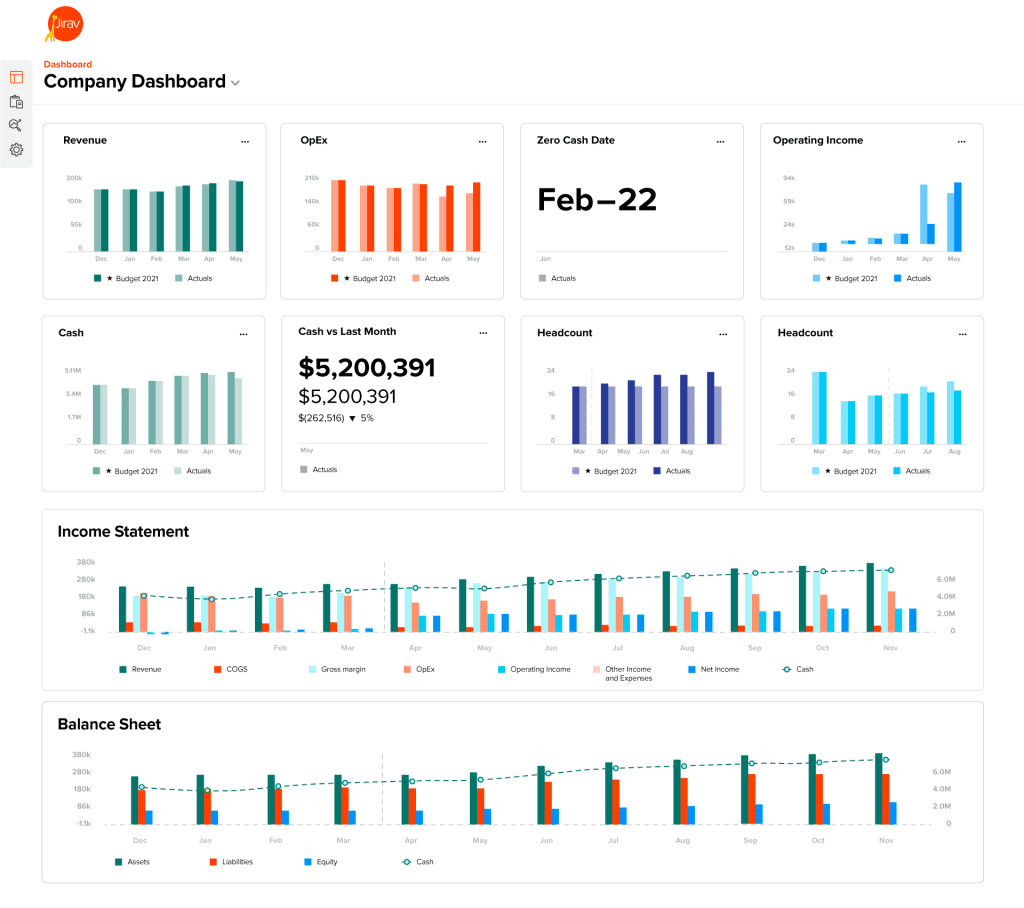

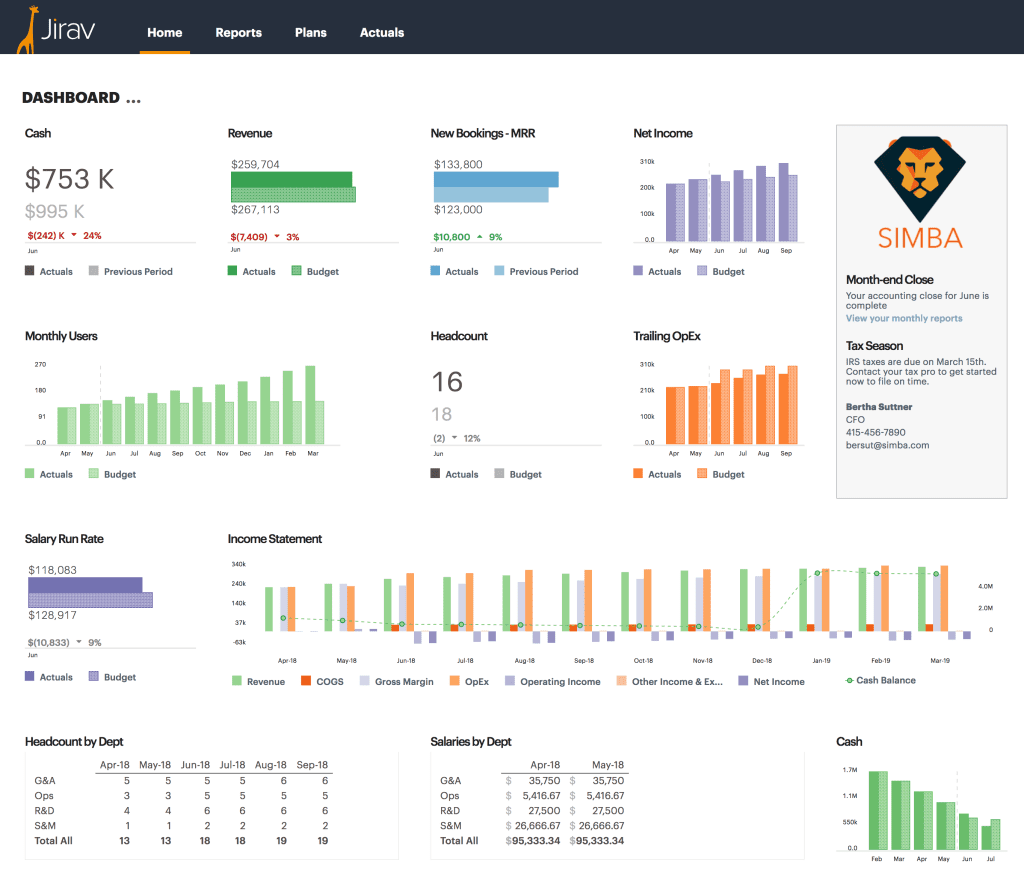

– Dashboards: Visualize your financial data in real-time, ensuring that stakeholders can quickly grasp the health of the business.

– Reporting: Generate comprehensive reports that offer deep insights into your financial performance.

Why Centage Stands Out

Centage is not just about features; it’s about delivering value:

– Improve Visibility: With a single source of truth, ensure that all stakeholders have a clear view of the financial landscape.

– Increase Agility: Adapt to changing business needs with continuous budgeting and planning.

– Save Time and Avoid Errors: Automate daily tasks, reducing manual errors and ensuring accuracy.

– Promote Collaboration: With role-based access, ensure that all stakeholders, from finance teams to executives, can collaborate effectively.

– Improve Decision-making: Test assumptions, generate predictions, and make informed decisions that drive business growth.

– Streamline Data Integration: With seamless general ledger connectivity, ensure that your financial data is always up-to-date.

—

Pricing and Plans

While the Centage website provides a comprehensive overview of its features and capabilities, specific details regarding pricing and plans were not explicitly mentioned. This is a common practice for enterprise-level software solutions, as pricing often varies based on the unique needs and scale of the organization. For a detailed breakdown of pricing and available plans, it would be best to directly reach out to Centage or request a demo through their website.

However, it’s evident that Centage is trusted by a diverse range of businesses, emphasizing its effectiveness in catering to various financial planning needs. The platform’s emphasis on simplifying FP&A, combined with its robust feature set, makes it a preferred choice for businesses looking to elevate their financial planning and analysis processes.

—

In conclusion, Centage offers a comprehensive solution for businesses looking to streamline their FP&A processes. With its range of features, from consolidation to scenario planning, and its emphasis on collaboration and visibility, Centage ensures that businesses are equipped with the tools and insights they need to navigate the complexities of financial planning in today’s fast-paced business environment.