LiveFlow

The Future of Real-time Financial Reporting

Product Information

LiveFlow: Transforming Spreadsheets into Dynamic FP&A Platforms

LiveFlow is a groundbreaking solution that turns traditional spreadsheets into scalable, real-time financial planning and analysis (FP&A) platforms. Recognizing the limitations of static spreadsheets and the need for real-time financial insights, LiveFlow offers a platform that automates advanced financial reporting, making it effortless and efficient.

The platform is designed to cater to various stakeholders, from accountants and CFOs to finance teams and startups across industries like technology, franchises, and construction. With LiveFlow, businesses can transition from manual data entry and reporting to automated, real-time insights, driving informed decision-making and strategic planning.

—

Features

LiveFlow: A Comprehensive Suite for Advanced Financial Reporting

LiveFlow boasts a myriad of features tailored to enhance the financial reporting and analysis process:

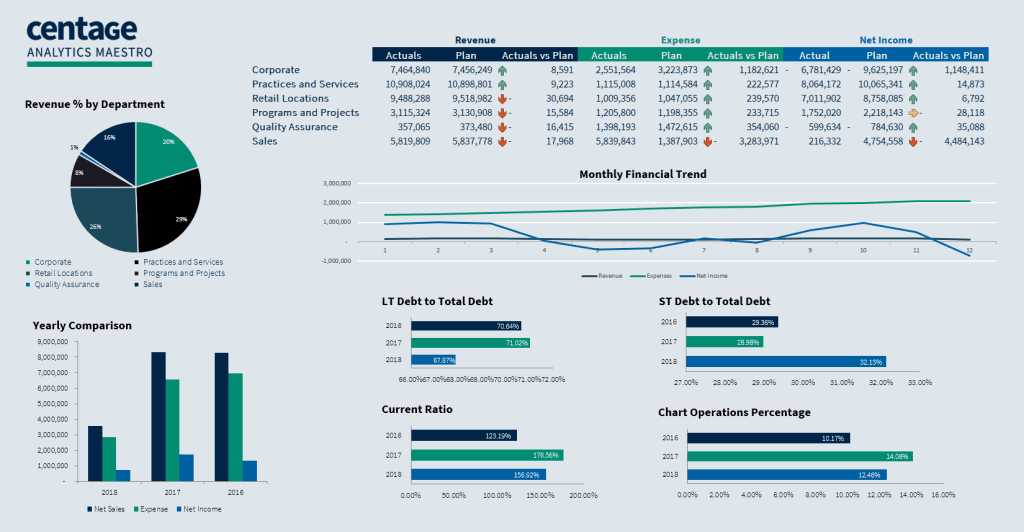

Real-time Analytics: With LiveFlow, businesses can access up-to-date KPIs and financial insights in real-time, ensuring timely and informed decision-making.

Collaborative Planning: The platform fosters a culture of collaboration, allowing various departments to align their objectives and strategies seamlessly.

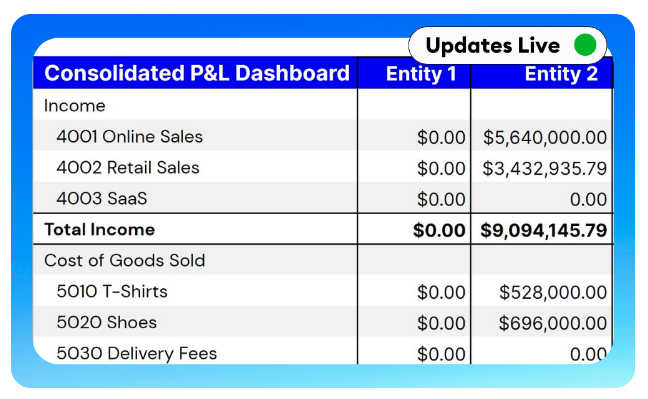

Automated Reporting: Say goodbye to downloading the same reports every month. Set up your reports once with LiveFlow, and they will auto-refresh, ensuring they are always up-to-date.

Drill Down Capability: No need to revert to other software to delve deeper into your reports. LiveFlow allows users to drill down directly within Google Sheets, saving time and effort.

Flexibility: Insert your own rows and columns directly in your live reports without the fear of them disappearing upon refreshing.

Integration with Popular Platforms: LiveFlow offers seamless integration with platforms like QuickBooks, ensuring comprehensive data connectivity and streamlined financial reporting.

Pre-designed Templates: LiveFlow provides users with more than 100 pre-designed templates, catering to various financial reporting needs, from Business KPI Dashboards to Live Budget vs. Actuals.

Security: Being SOC-2 compliant, LiveFlow prioritizes data security, ensuring that sensitive financial data is protected with state-of-the-art security processes.

—

Pricing and Plans

The specific details regarding LiveFlow’s pricing and plans were not explicitly mentioned on the provided page. As is common with software solutions, pricing often varies based on the unique needs and scale of the organization. For those interested in understanding the cost structure, LiveFlow offers the option to book a personal demo, which can be accessed via their website.

LiveFlow’s platform is trusted by numerous companies, emphasizing its effectiveness in automating financial reporting and providing real-time insights. The platform’s emphasis on real-time analytics, combined with its robust feature set, makes it a preferred choice for businesses looking to elevate their financial reporting processes.

—

In conclusion, LiveFlow offers a comprehensive solution for businesses aiming to streamline their financial reporting and analysis processes. With its range of features, from real-time analytics to collaborative planning, and its emphasis on flexibility and integration, LiveFlow ensures that businesses are equipped with the tools and insights they need to navigate the complexities of financial reporting in today’s digital age.