Oracle PBCS

Product Information

Oracle Planning Cloud is a leading-edge financial planning and analysis (FP&A) solution, designed to cater to the dynamic needs of businesses in managing their financial processes. It’s part of Oracle’s broader Cloud Enterprise Performance Management (EPM) suite. This solution harnesses the power of the cloud to offer scalable, flexible, and integrated planning capabilities. It enables businesses to streamline their budgeting, forecasting, and reporting processes with a robust, user-friendly interface. Oracle Planning Cloud is engineered to support a wide range of financial planning activities, including operational budgeting, strategic planning, financial forecasting, and scenario modeling.

Features

Seamless Integration

Oracle Planning Cloud seamlessly integrates with various data sources and systems, ensuring data consistency and accuracy. This integration capability enhances data-driven decision-making, providing a holistic view of the company’s financial health.

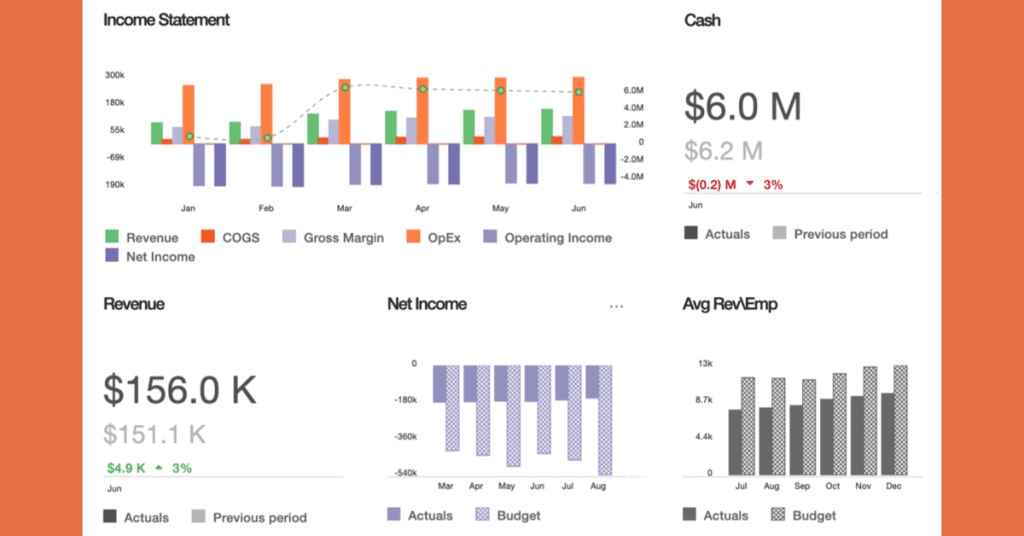

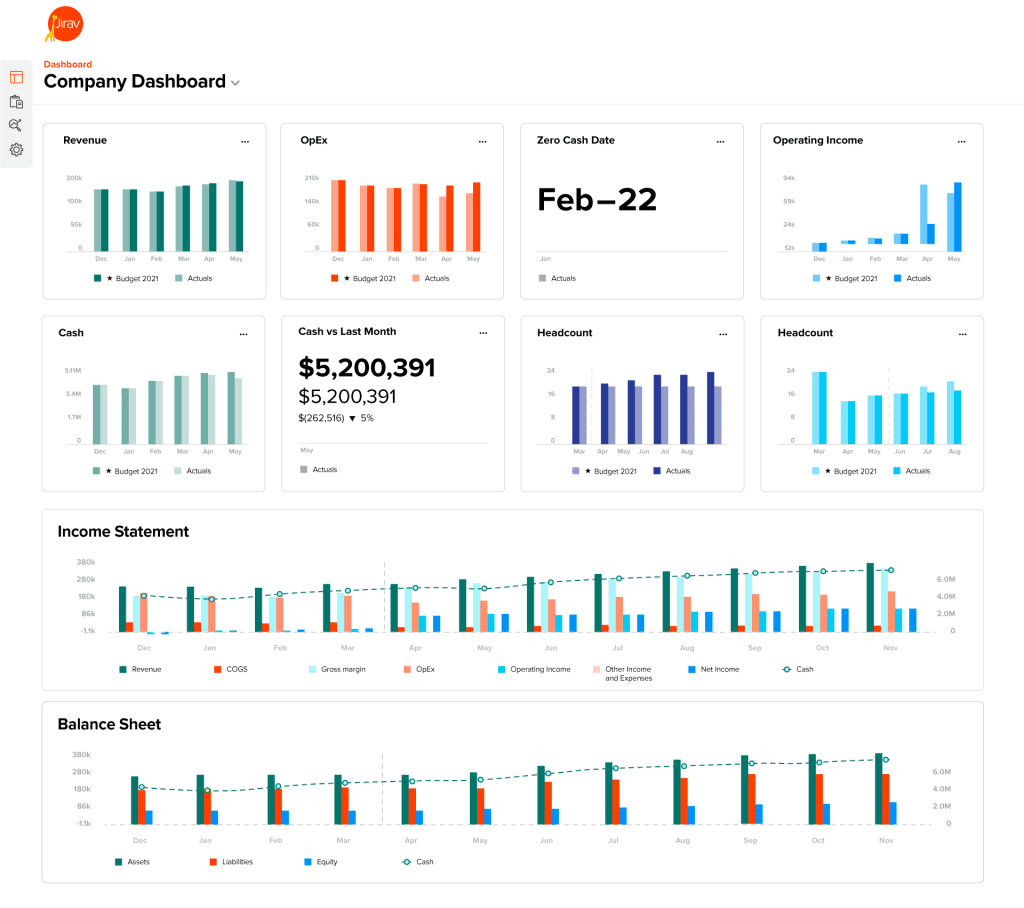

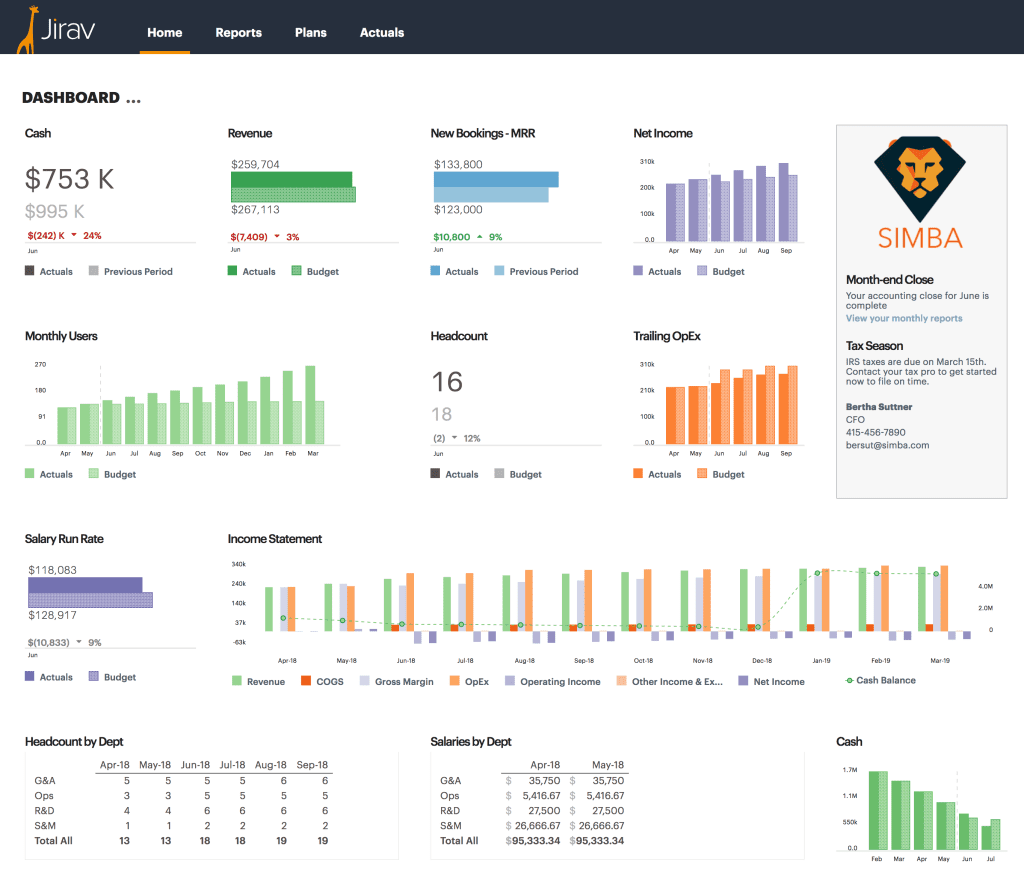

Advanced Analytics and Reporting

The platform comes equipped with advanced analytics and reporting tools. These tools allow users to create detailed financial reports and dashboards, offering insights into key performance indicators (KPIs) and financial trends.

Scenario Modeling and Forecasting

With its robust scenario modeling and forecasting features, Oracle Planning Cloud empowers businesses to anticipate future financial outcomes. Users can model different financial scenarios, assess their impact, and make informed decisions.

Collaboration and Workflow Management

Enhanced collaboration tools and workflow management capabilities are at the core of Oracle Planning Cloud. These features enable teams to work cohesively, streamline approval processes, and ensure alignment across the organization.

Customization and Flexibility

The platform is highly customizable, allowing businesses to tailor it to their unique needs. Its flexibility ensures that it can adapt to various industry-specific requirements and changing business environments.

Cloud-Based Advantage

Being a cloud-based solution, Oracle Planning Cloud offers the advantages of scalability, security, and reduced IT overhead. This makes it an ideal choice for businesses looking to leverage cloud technology for their financial planning processes.

Pricing and Plans

Oracle Planning Cloud offers a variety of pricing and plan options to suit different business sizes and requirements. While specific pricing details may vary and should be obtained directly from Oracle, the general structure includes:

Subscription-Based Model

The service operates on a subscription-based model, offering flexibility and scalability. Businesses can choose plans based on their size, user count, and required features.

Customizable Plans

Organizations can opt for customizable plans that cater specifically to their needs. This includes options for additional modules, user licenses, and support services.

Free Trials and Demos

Oracle often provides free trials or demos, allowing businesses to experience the platform’s capabilities before committing to a subscription.

Enterprise Agreements

For larger organizations, Oracle offers enterprise agreements that include customized pricing and terms, aligning with the organization’s broader IT and financial strategies.

Summary

Oracle Planning Cloud stands out as a comprehensive, cloud-based FP&A solution, offering a blend of flexibility, robust features, and integration capabilities. Its advanced analytics, reporting tools, and scenario modeling features make it a powerful tool for financial planning and decision-making. The platform’s scalability and customizable plans make it suitable for a wide range of businesses, from small startups to large enterprises. As part of Oracle’s EPM suite, it represents a key component in the digital transformation of financial processes, driving efficiency, and strategic insight in today’s fast-paced business environment.