Jirav – The Future of Financial Planning and Analysis

Product Information

Jirav: Dynamic Forecasting, Budgeting, and Reporting Solution

Jirav emerges as a comprehensive solution for businesses aiming to elevate their financial planning, forecasting, and reporting processes. It’s an all-in-one platform that is purpose-built for the accounting and finance heroes, ensuring that every dollar and decision is meticulously accounted for. Jirav’s platform is designed to be dynamic, catering to the ever-evolving needs of modern businesses.

The platform is built with a focus on integrating accounting, workforce, and operational data, creating a foundation for an advanced planning and analytics engine. This ensures that businesses can quickly adjust their strategies, keeping pace with the changing market dynamics.

Jirav’s commitment to transforming the financial landscape is evident in its approach. By offering a platform that integrates seamlessly with existing systems, it ensures that businesses have a single source of truth. This not only improves visibility but also ensures that all stakeholders, from finance teams to executives, are aligned in their decision-making processes.

—

Features

Jirav: A Suite of Features Tailored for Modern Financial Planning

Jirav offers a plethora of features designed to streamline and enhance the financial planning process:

– Data Integration: Seamlessly connect your accounting, workforce, and operational data, ensuring a comprehensive view of your financial landscape.

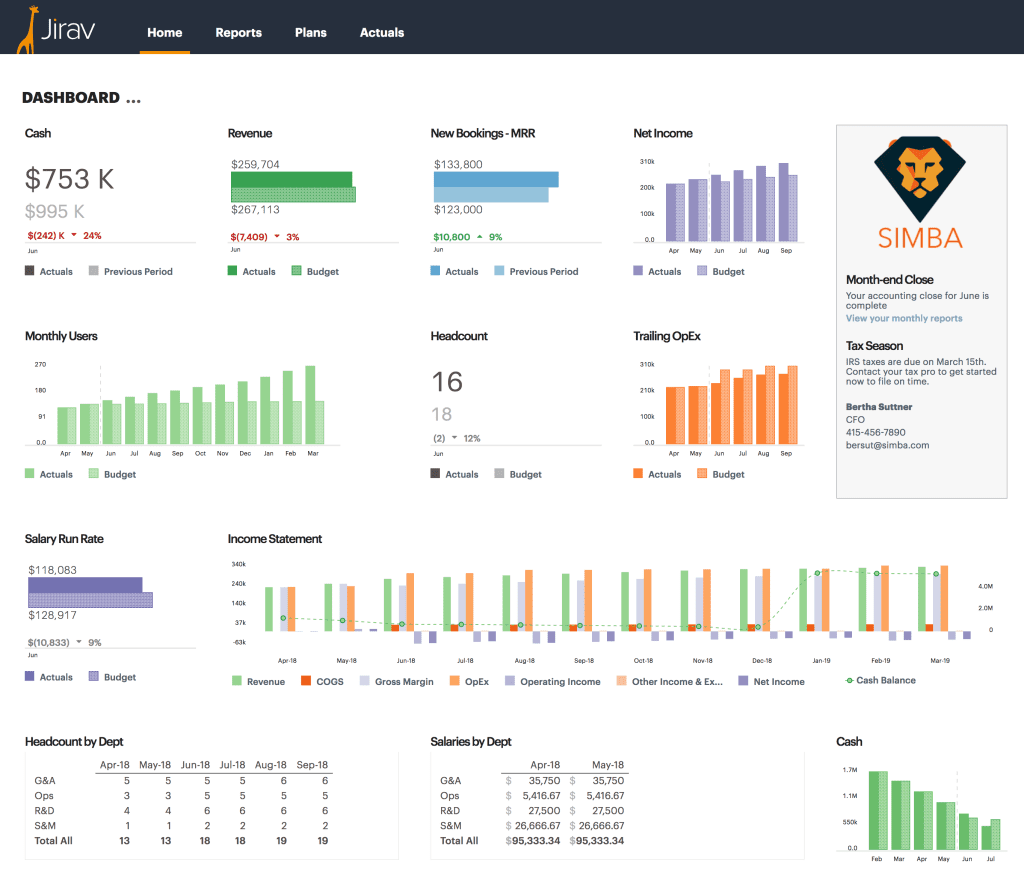

– Dynamic Planning: Construct budgets, forecasts, and multiple scenario plans to quickly analyze changes in the business, ensuring that you’re always on track to achieve your growth milestones.

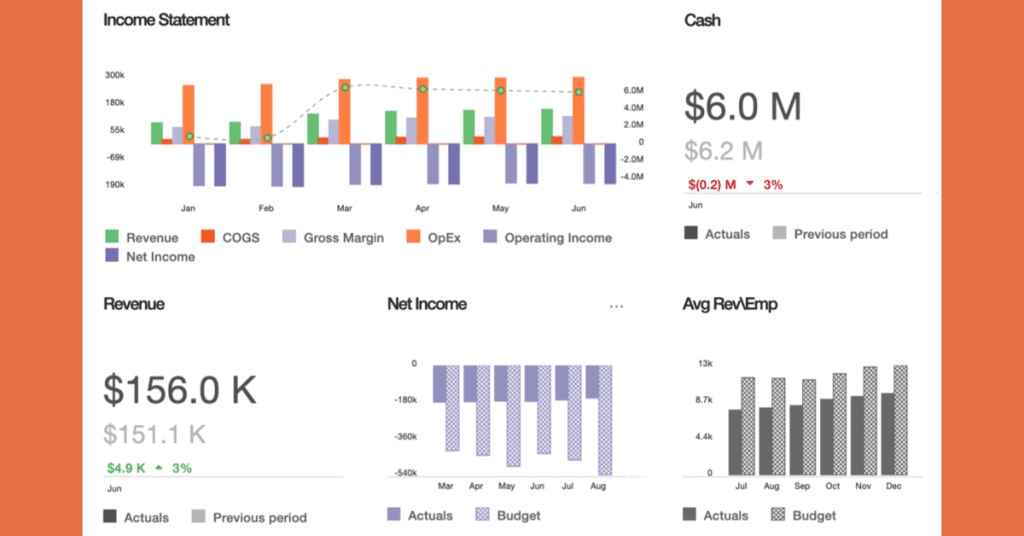

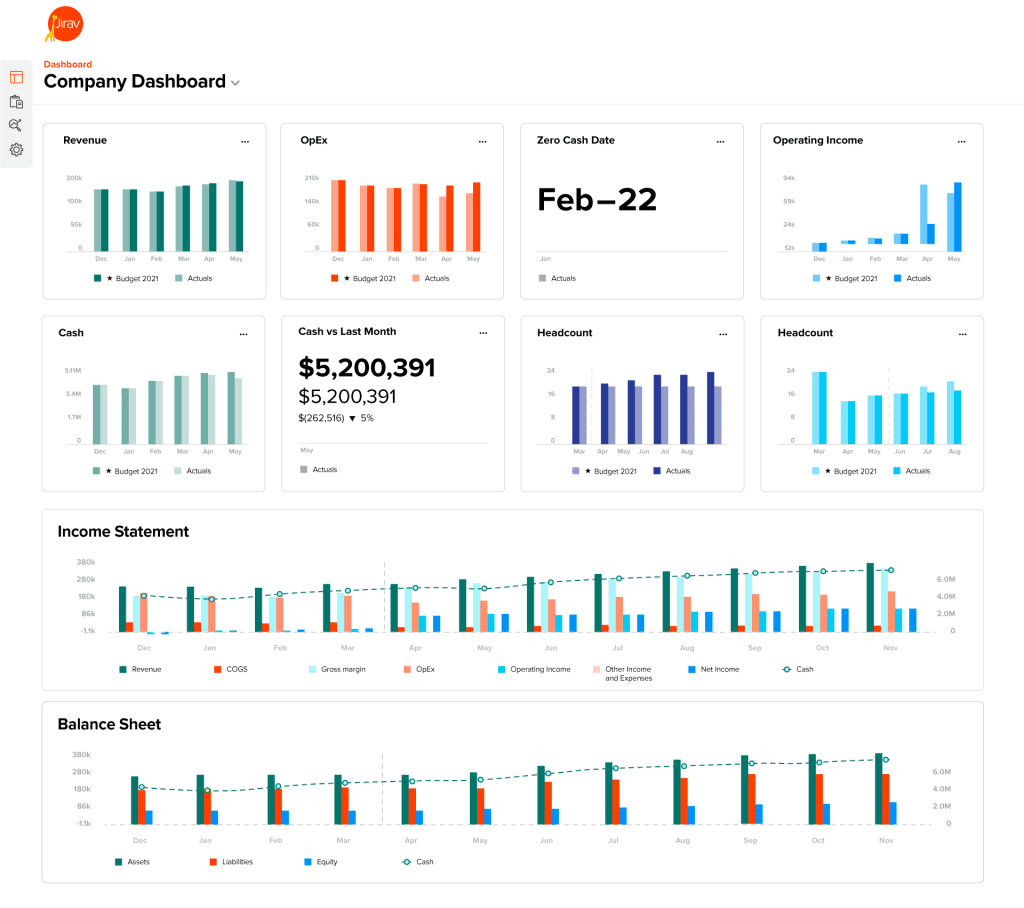

– Intelligent Analysis: Automate reporting and analytics; compare actuals to budget, along with multiple planning scenarios, to make real-time and informed business decisions.

– Budgeting: Embrace a dynamic approach to budgeting that leverages Jirav’s 3-statement, pro forma modeling, ensuring that you can easily create leadership-approved plans.

– Forecasting: Adjust mid, long-range, and rolling forecasts in minutes, keeping a constant pulse on your cash flow and working capital assumptions.

Planning and Reporting

– Scenario Planning: Create multiple scenarios based on board or leadership input, ensuring that your decision-making is always informed.

– Reporting & Dashboarding: Streamline your monthly close process, create and deliver financial packages with just a few clicks, and use industry-specific templates or create customized reports to share and collaborate with key stakeholders.

– Integrations: Jirav offers optimized integrations with various accounting and operational systems, ensuring that no data is left behind and the financial planning process is comprehensive.

—

Pricing and Plans

While the Jirav website provides a comprehensive overview of its features and capabilities, specific details regarding pricing and plans were mentioned in their pricing page. This pricing often varies based on the unique needs and scale of the organization. For those interested in understanding the cost structure, Jirav offers the option to book a demo or request more information through their website.

Jirav’s platform is trusted by a diverse range of businesses, from small to large enterprises, and even accounting firms. This indicates its versatility and capability to cater to various financial planning needs, making it a valuable tool for businesses aiming to streamline their financial processes.

—

In conclusion, Jirav offers a comprehensive solution for businesses looking to elevate their financial planning, forecasting, and reporting processes. With its range of features, from data integration to scenario planning, and its emphasis on collaboration and visibility, Jirav ensures that businesses are equipped with the tools and insights they need to navigate the complexities of financial planning in today’s fast-paced business environment.