Mosaic Tech – The Strategic Finance Platform for Modern Businesses

—

Product Information

Mosaic: Bridging the Gap Between Data and Decision

Mosaic stands out as a strategic finance platform tailored for today’s dynamic business environment. It offers real-time analytics and planning capabilities, ensuring that businesses can swiftly transition from data to decision-making. Recognizing the challenges that finance teams often face, from data consolidation to real-time reporting, Mosaic provides a solution that addresses these concerns head-on.

At its core, Mosaic is designed to be more than just a financial tool; it’s a platform that integrates accounting, workforce, and operational data. This integration forms the foundation for its advanced planning and analytics engine, enabling businesses to adjust their strategies in real-time, keeping pace with market dynamics.

Mosaic’s commitment to revolutionizing the financial landscape is evident in its approach. By offering a platform that seamlessly integrates with existing systems, it ensures a single source of truth for businesses, improving visibility and ensuring alignment among all stakeholders.

—

Features

Mosaic: A Comprehensive Suite of Features for Strategic Finance

Mosaic offers a plethora of features designed to enhance the financial planning process:

– Real-time Analytics: Mosaic provides a platform that helps teams transition from data to decision-making swiftly, ensuring timely insights and strategic actions.

– Strategic Finance: The platform emphasizes the need for finance teams to shift from a reactive mode, which often involves wrangling data, to a proactive approach that focuses on the future. This is achieved by integrating data, automating analytics, and fostering team collaboration.

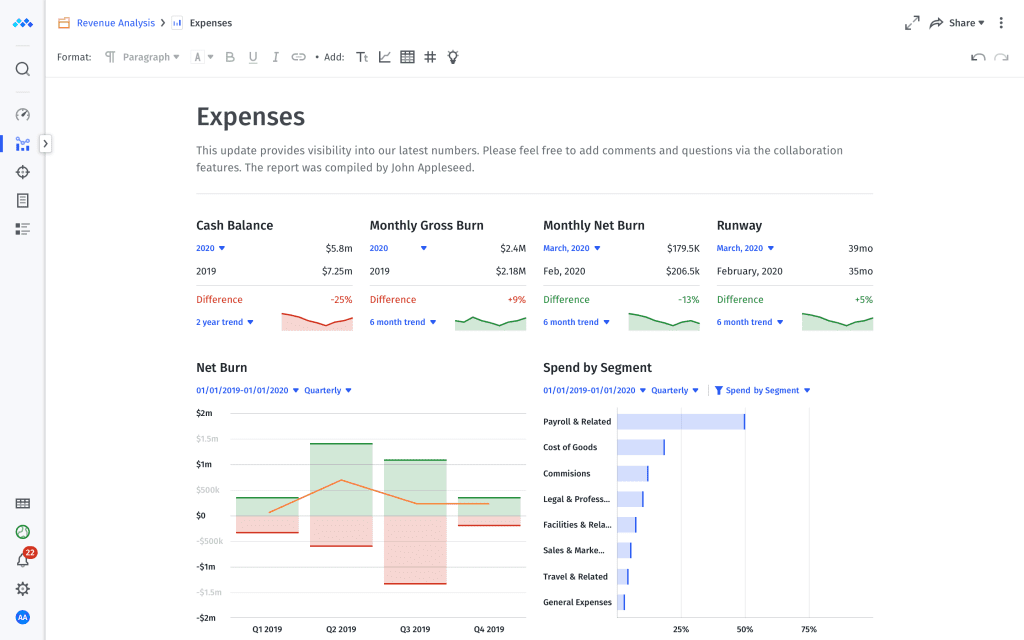

– Effortless Analysis: Drive performance and cross-functional collaboration with user-friendly dashboards, data visualizations, and automated insights. Ensure that critical metrics are always up-to-date and available in real-time.

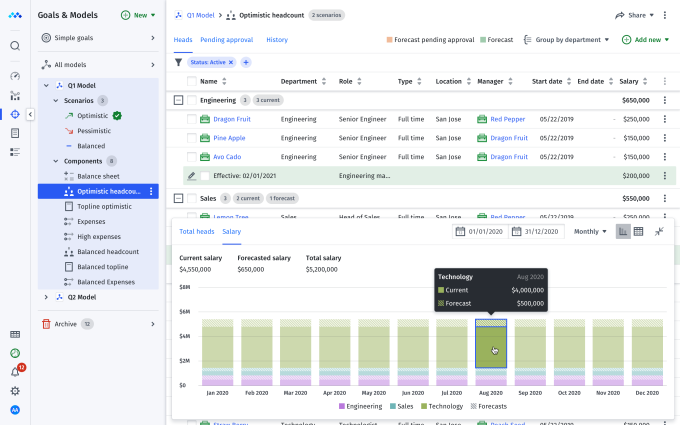

– Agile Planning: Trust your planning process with Mosaic’s flexible financial planning capabilities. Easily model and adapt to rapidly changing conditions, ensuring accuracy and collaboration.

Integrations and Collaboration

– Integrations: Mosaic offers out-of-the-box integrations that unlock the value trapped within existing systems. This ensures seamless data connectivity without burdening the engineering team with tedious implementations.

– Real-time Reporting: Share insights with key stakeholders in real-time, create departmental or executive views for monthly reporting, due diligence, and go-to-market analysis.

– Accelerated Decision-making: Focus on the right signals to drive growth, make informed decisions on expanding teams, allocating marketing spend, or raising additional funding.

– Collaboration: Foster a culture of unity around common goals, establish collaborative benchmarks, and easily track variances to identify growth opportunities.

—

Pricing and Plans

While the Mosaic website provides an in-depth overview of its features and capabilities, specific details regarding pricing and plans were not explicitly mentioned. For those interested in understanding the cost structure, Mosaic offers the option to chat and get a demo through their website.

Mosaic’s platform is trusted by a diverse range of businesses, emphasizing its effectiveness in catering to various financial planning needs. The platform’s emphasis on strategic finance, combined with its robust feature set, makes it a preferred choice for businesses looking to elevate their financial planning and analysis processes.

—

In conclusion, Mosaic offers a comprehensive solution for businesses aiming to streamline their financial planning, forecasting, and reporting processes. With its range of features, from real-time analytics to strategic finance, and its emphasis on collaboration and visibility, Mosaic ensures that businesses are equipped with the tools and insights they need to navigate the complexities of financial planning in today’s fast-paced business environment.